Tax-loss harvesting means deliberately selling an asset for a loss to mitigate profits from another asset. You haven’t taken a primary residence exemption in two years.Living in the home as the primary residence for two or more of the last five years.Owning the home for two or more of the last five years.Using this option means fulfilling the following requirements: You can also avoid paying taxes on depreciation deductions this way.

The internal revenue service (IRS) exempts primary residence sales from capital gains taxes up to $500,000 for married joint filers and $250,000 for single filers. Plus, your IRA contributions can garner you another tax deduction. Depositing investment profits in your investment account allows your money to grow tax-free. Instead, you can use your individual retirement account (IRA) or 401(k). You don’t have to invest in real estate with dollars from your bank account. You can use a variety of strategies to avoid capital gains on real estate properties: Use Tax-Deferred Funds

Capital gains tax brackets how to#

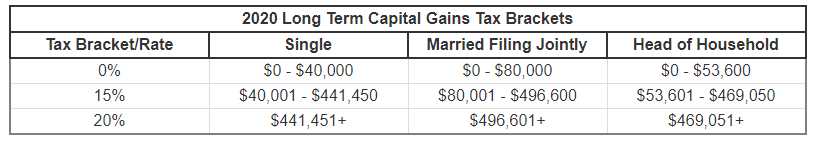

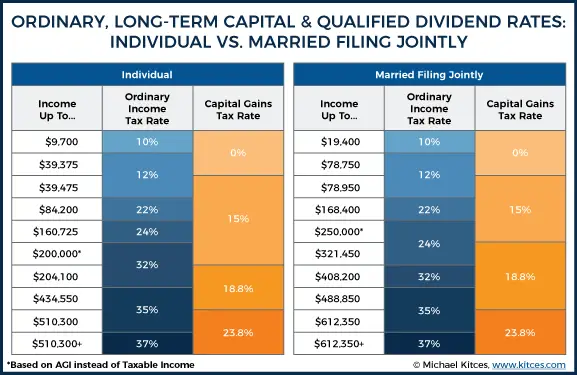

How to Limit Capital Gains on Real Estate Investment Properties The 20% rate applies if they earn more than $553,850. The 15% rate applies if the couple earns $89,251 to $553,850. In addition, single filers making $125,000 or more annually will pay a net investment income tax of 3.8% on capital gains from real estate.Ī married couple filing 2023 taxes jointly will pay 0% if they earn up to $89,250. Finally, single filers with income above $492,300 will pay 20% long-term capital gains taxes. Single filers with income between $44,626 and $492,300 will pay 15%. For 2023, single filers making up to $44,625 receive the 0% rate. In addition, you’re a single filer, putting a portion of your income in the 24% tax bracket.Ĭonversely, long-term capital gains have different tax rates than short-term gains: 0%, 15%, and 20%, depending on your income level and filing status. The sale results in a short-term capital gain, and your income is $115,000 when you file taxes. You sell an investment property nine months after purchasing it and make a $30,000 profit. Your income determines your capital gains tax rates.įor example, say you make $85,000 from your day job. The IRS taxes short-term capital gains as standard income, meaning your income tax bracket will determine your tax rate. So, if you sell an investment property, the time you owned it before selling it will determine what kind of capital gains taxes you pay. On the other hand, long-term capital gains come from selling assets after holding them for a year or more. Short-term capital gains are from selling assets you’ve held for less than a year. You can incur two types of capital gains taxes: short-term and long-term. You pay capital gains taxes when you profit from selling assets.

0 kommentar(er)

0 kommentar(er)